accumulated earnings tax form

The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of paying dividends. See Form IT-205-J-I Instructions for Form IT-205-J.

What Are Accumulated Earnings Definition Meaning Example

If you electronically file the.

. An accumulated earnings tax is a tax imposed by the federal government on corporations with retained earnings deemed to be unreasonable or unnecessary. Tax-exempt organizations Publicly held corporations assume it fails the stock ownership test. Closely held corporations b.

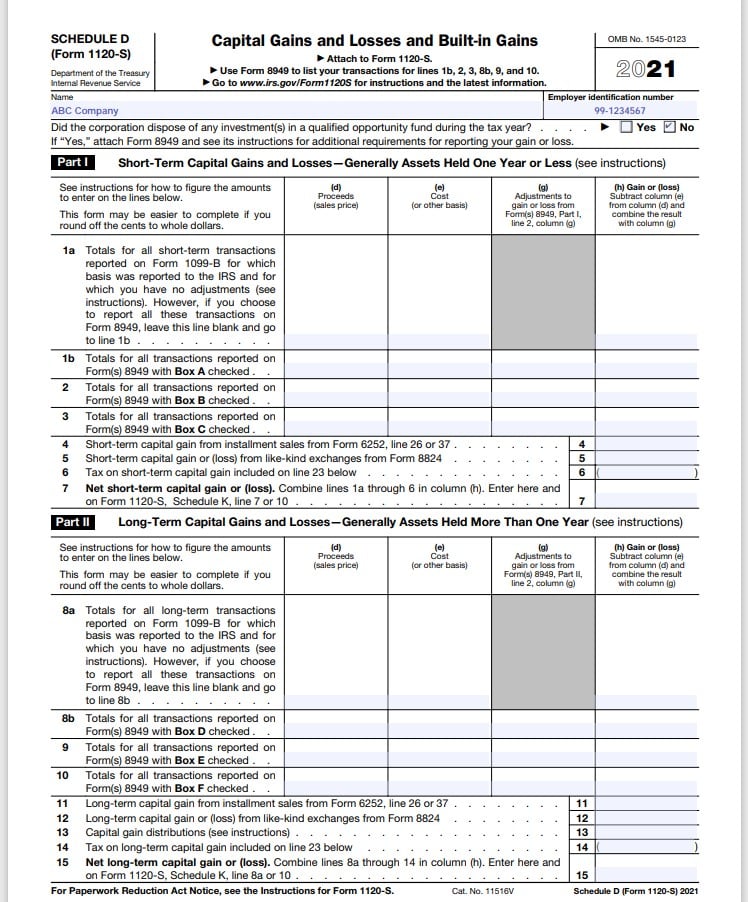

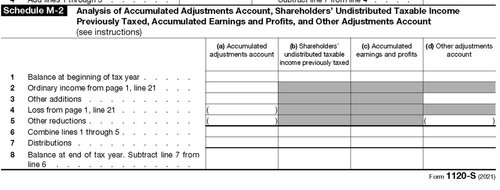

Accumulated tax earning is a form of encouragement by the government to give. S Corp Tax Return Irs Form 1120s White Coat Investor In 2021 Irs Forms Tax Return Irs. The accumulated earnings tax AET is a penalty tax imposed on corporations for unreasonably accumulating earnings in the corporation.

States and the amount of income tax paid to each state. These retained earnings which are not paid out to shareholders in the form of dividends appear in the shareholders equity section of the companys financial report. The tax is assessed at the highest individual tax rate.

Name of trust Employer. December 2020 Department of the Treasury Internal Revenue Service OMB. Submit with Forms IT-205 and IT-205-C if the trust meets the conditions of Tax Law section 658f.

However if a corporation allows earnings to accumulate. SCHEDULE J Form 5471 Accumulated Earnings Profits EP of Controlled Foreign Corporation Rev. A corporation can accumulate its earnings for a possible expansion or other bona fide business reasons.

1120 or Schedule M-3 Form 1120 for the tax year also attach a schedule of the differences between the earnings and profits computation and the Schedule M-1 or Schedule M-3. Submit with Form 5S a copy of the income tax return filed with each state for which a credit is claimed.

Chapter 2 C Corporations Flashcards Quizlet

How To Prepare An S Corporation Tax Return Online Tax Professionals

/GettyImages-1130199515-b011f8c58a144789b22c7107929ffb8f.jpg)

Accumulated Earnings Tax Definition

Irs Expands On Reporting Expenses Used To Obtain Ppp Loan Forgiveness On Form 1120s Schedule M 2 Current Federal Tax Developments

How To File S Corp Taxes Maximize Deductions White Coat Investor

How To Complete Form 1120s Schedule K 1 With Sample

Bir Income Tax Return Ep 58 Bir Form No 1704 Improperly Accumulated Earnings Tax Return For Corporations Description This Form Is To Be Filed By By Bir Revenue District Office 107 Cotabato City Facebook

S Corporations Should Include A Balance Sheet With Their Tax Return

Cch Federal Taxation Comprehensive Topics Chapter 18 Accumulated Earning And Personal Holding Company Taxes C 2005 Cch Incorporated 4025 W Peterson Ave Ppt Download

Darkside Of C Corporation Manay Cpa Tax And Accounting

1120s504 Form 1120 S Income Tax Return For An S Corporation Page 5 Nelcosolutions Com

Solved Please Note That This Is Based On Philippine Tax System Please Put Course Hero

Improperly Accumulated Earnings Tax Iaet Summary Of Corporate Income Taxation Youtube

Demystifying Irc Section 965 Math The Cpa Journal

Doing Business In The United States Federal Tax Issues Pwc

How To Complete Form 1120s Schedule K 1 With Sample

Determining The Taxability Of S Corporation Distributions Part I