child care tax credit 2020

The canada revenue agency cra administers the ontario child. Introduced in Senate 03282019 Child and Dependent Care Tax Credit Enhancement Act of 2019.

How To Take Advantage Of The Expanded Tax Credit For Child Care Costs

For example if you had a much higher income in 2021 as compared to 2020 then your Child Tax Credit amount could be reduced.

. The 2020 Child Tax Credit is intended to help offset the tremendous costs of raising a child or children. This credit is also. 10 of federal credit.

Greater than 60000 and up to 150000. To qualify for the credit your dependent must have lived with. Prep save and e-file.

This credit maxes out at 1050 for one qualifying child under age 13 or 2100 for two or more kids. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. In tax year 2020 the amount of qualified expenses that could be used to calculate the credit was up to 3000 for.

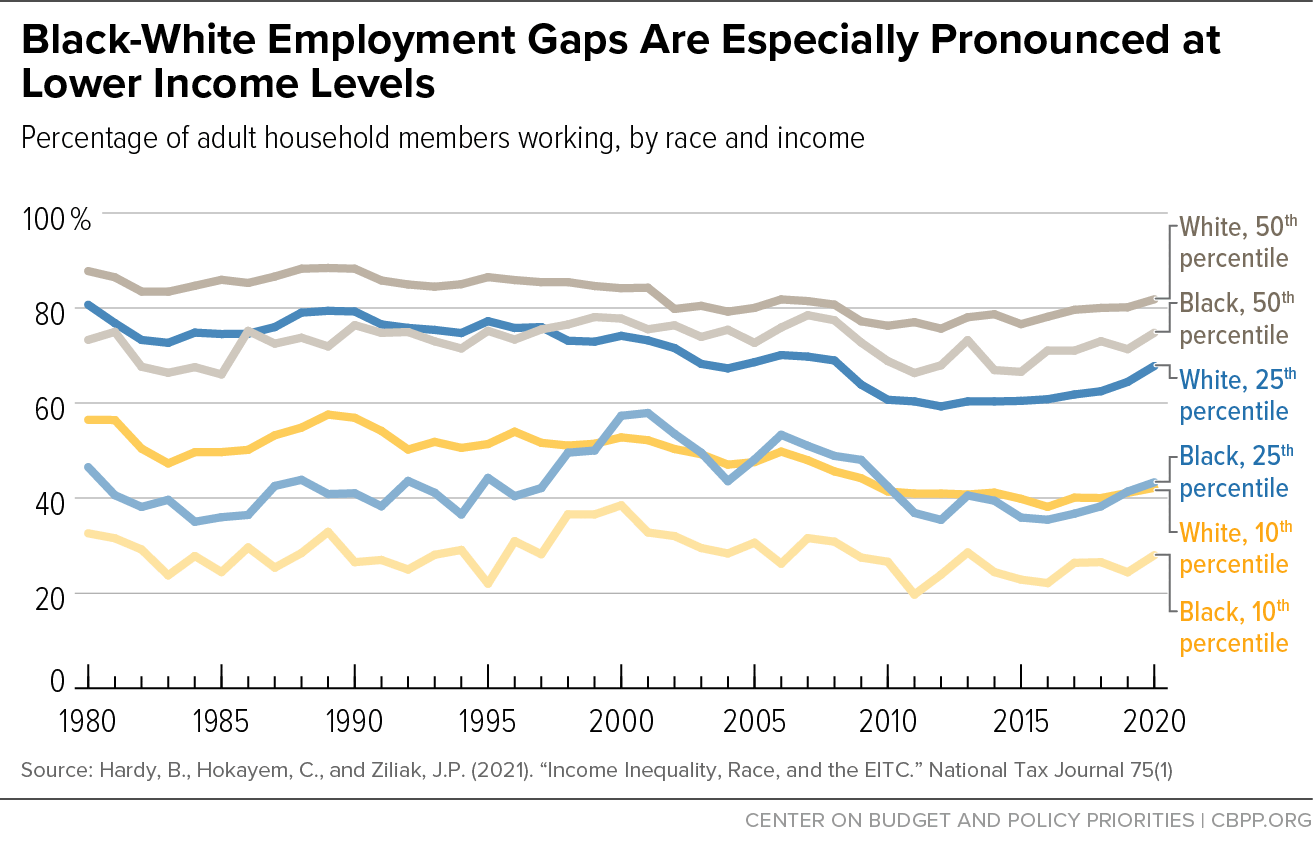

Helpful guidance and explanations so you can file accurately. 59 minus 2 percentage points for each 5000 or part of above 40000. Child care in the United States is expensive.

Use these Calculator Tools for the current tax yearPrepare and e-File the current tax year. A childs age determines the amount. The eFile Tax Season for the current calendar year Returns starts in next year January.

Also for tax year 2021 the maximum amount that can be. Community Coordinated Child Care 225 Long Avenue Bldg 15. Information on how to claim the 2020 Child and Dependent Care Credit can be found on page 34 of the 2020 NJ-1040 Instructions.

EFileIT Information on current tax year Child Care Dependent Credit. It is a partially refundable tax credit if you had earned income of at. The beginning of the reduction of the credit is increased from 15000 to 125000 of adjusted gross income AGI.

The Child Care Tax Credit helps working parents pay for daycare expenses for children under 13 incapacitated spouses and qualifying adult dependents. Changes for the Child and Dependent Care Tax Credit. Calculating the Child and Dependent Care Credit until 2020.

This credit is equal to 25 of the federal credit for child and dependent care expenses. Emergency Assistance General Assistance End Hunger NJ. The child care tax credit is a good claim on 2020 taxes even better for 2021 returns Thursday March 11 2021.

The credit doubles if the expenses are related to a quality child care provider. Tax software you can log in to and use anywhere. The 2020 Child Tax Credit.

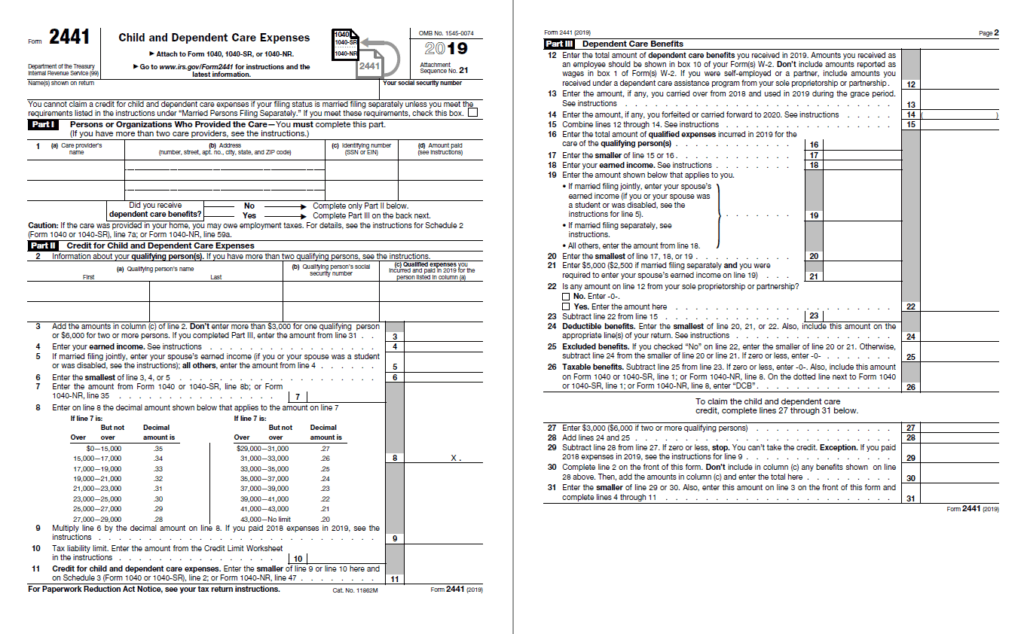

You will need to file IRS Form 2441 with your personal federal income tax return in order to claim the. Complete IRS Tax Forms Online or Print Government Tax Documents. On the other hand a loss of income in 2021 would not reduce.

Youll need your caregivers taxpayer identification number generally their. 51 minus 2 percentage points for each 3600 or part of above 60000. For 2021 eligible parents or guardians.

You can no longer eFile 2020 Tax Returns. Moreover the maximum amount a taxpayer could claim was up to 3000 for one child and. How do I claim the child care tax credit on my 2022 taxes and what can I expect to save.

This bill modifies the tax credit for employment-related. In general for 2021 you can exclude up to 10500 for dependent care benefits received from your employer. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

The tool on this page is only for tax year 2020 not the current tax year. The national average cost is 11666 per year for each child but. Earned Income Tax Credit.

Additionally in general the expenses claimed may not exceed. The Child Tax Credit is worth up to 2000 for each dependent child under the age of 17 at the end of the tax year. Up to 3000 per qualifying dependent child 17 or younger on Dec.

Up to 3600 per qualifying dependent child under 6 on Dec. In urban areas the cost is for care at a child care center and for home care in rural areas. For the 2021 tax year the child tax credit offers.

In 2020 for instance the CDCTC was 20 percent to 35 percent of qualified childcare expenses. For 2021 the American Rescue Plan Act of 2021 the ARP increases the amount of the credit for child and dependent. Changes to the credit for child and dependent care expenses for 2021.

25 State Filing. Child and Dependent Care Credit. Figure represents the average of costs for annual care of an infant and a 4-year-old.

Energy Assistance Programs DCA. Last March parents were frantically searching for day. For tax years through 2020 the Dependent Care Credit is 20 to 35 of qualified expenses.

The percentage depends on your.

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Child Tax Credit Has A Critical Role In Helping Families Maintain Economic Stability Center On Budget And Policy Priorities

:max_bytes(150000):strip_icc()/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)

Form 2441 Child And Dependent Care Expenses Definition

Family Tax Deductions What Can I Claim 2022 Turbotax Canada Tips

How To Claim The Child Tax Credit Up To 8 000 For Child Care Expenses Nextadvisor With Time

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Premium Tax Credit Definition

The 8 000 Child Tax Credit That Many Parents May Not Know About Cbs News

Family Tax Deductions What Can I Claim 2022 Turbotax Canada Tips

What Are Marriage Penalties And Bonuses Tax Policy Center

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

The 8 000 Child Tax Credit That Many Parents May Not Know About Cbs News

Parents Of 2021 Babies Can Claim Child Tax Credit Payments Here S How Cnet

What Is The Difference Between Refundable And Nonrefundable Credits Tax Policy Center

Child Tax Credit Update What Is Irs Letter 6419 Gobankingrates

Schedule 8812 What Is Irs Form Schedule 8812 Filing Instructions

The Expanded Child Tax Credit Briefly Slashed Child Poverty Npr

Dependent Care Benefits Overview Criteria Types

Where S My Child Tax Credit Payment A Guide For Frustrated Parents The Washington Post